A new report lays out the financial risks posed by antimicrobial resistance (AMR) and how investors might be able to mitigate them.

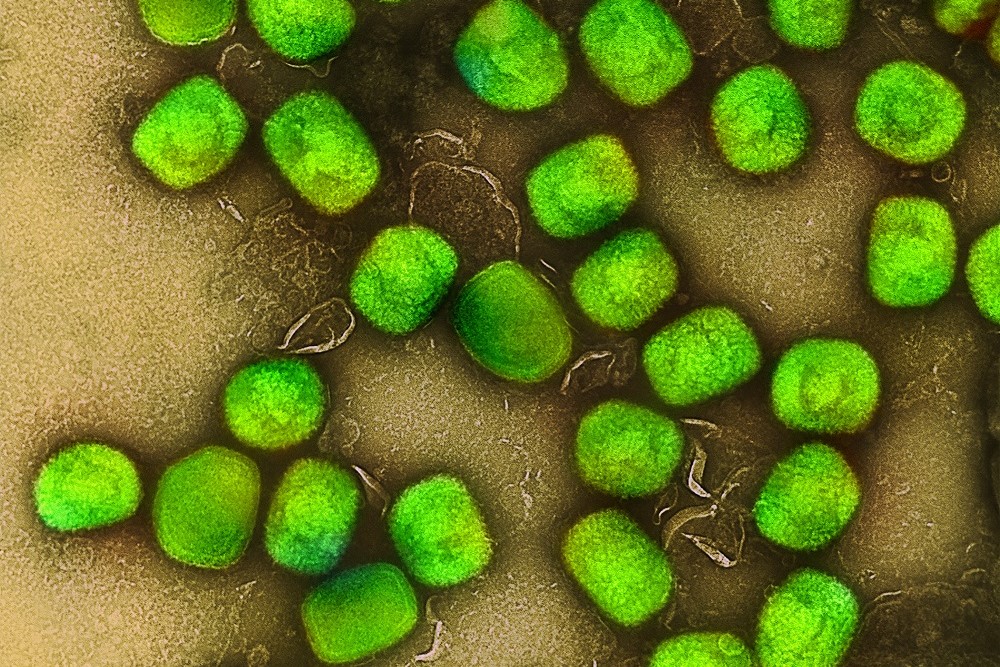

The health risks posed by drug-resistant pathogens are already well known. A 2022 study published in The Lancet estimated that AMR was directly responsible for 1.27 million deaths, and contributed to an additional 3.7 million deaths, in 2019. That’s more than the number of deaths caused by HIV/AIDS, malaria, and many cancers.

But the report published this week by the Farm Animal Investment Risk & Return (FAIRR) initiative, the MSCI Sustainability Institute, and Investor Action on AMR highlights the significant financial costs. According to World Bank estimates, unchecked drug-resistance could cause annual gross domestic product losses ranging from US $1 trillion to $3.4 trillion by 2030, driven by increased human and veterinary healthcare costs, reduced productivity, and declines in global livestock production. Those losses could rise to $100 trillion by 2050 if the weak pipeline for new antibiotics continues to falter.

Incorporating an ‘AMR lens’ into investment decisions

But investors can play a role in addressing AMR by incorporating an “AMR lens” into investment decisions, the report suggests. This means identifying opportunities to invest in companies that are part of the solution to AMR and avoiding investments that exacerbate it. One clear area of opportunity is antibiotic research and development

“Investors can play a pivotal role in driving the research and development of new antibiotics, diagnostics, and alternative treatments,” the report states. “By providing the necessary funding, investors can help accelerate the pace of innovation and commercialization of solutions.”

Investors can play a pivotal role in driving the research and development of new antibiotics, diagnostics, and alternative treatments.

In addition, the report suggests that investors can work with companies in the livestock sector to encourage them to reduce inappropriate antibiotic use and adopt alternative treatment strategies, invest in global AMR surveillance systems that will help companies with global risk planning, and support healthcare companies that are using tools and databases to evaluate appropriate antibiotic use.

“By working collaboratively, investors can address existing gaps and promote sustainable practices,” the report states. “Understanding the economic impact, integrating AMR into investment decisions, and supporting research and innovation are crucial.”